In today’s unpredictable world, health insurance is more than just medical coverage. It supports personal well-being and financial security. During the open enrollment period for 2022 coverage, which spanned from November 1, 2021, to January 15, 2022, an unprecedented 2,723,094 Floridians chose plans via the Florida Exchange.

What is Health Insurance?

Health insurance is a contract in which an insurance company agrees to cover specific medical expenses in exchange for a premium. These expenses can arise from illnesses, injuries, surgeries, preventive services, and other health-related needs.

Depending on the insurance policy and terms, an insured individual might pay for services upfront and later get reimbursed, or the provider might bill the insurance company directly. In the latter scenario, the patient typically pays a copayment, deductible, or coinsurance at their appointment.

The term “provider” refers to entities like doctors, clinics, hospitals, pharmacies, and other designated practitioners recognized by the insurance company. It’s important to understand that not all medical services are covered by every policy, and the coverage specifics are detailed in the insurance policy’s terms.

What Does Health Insurance Cover?

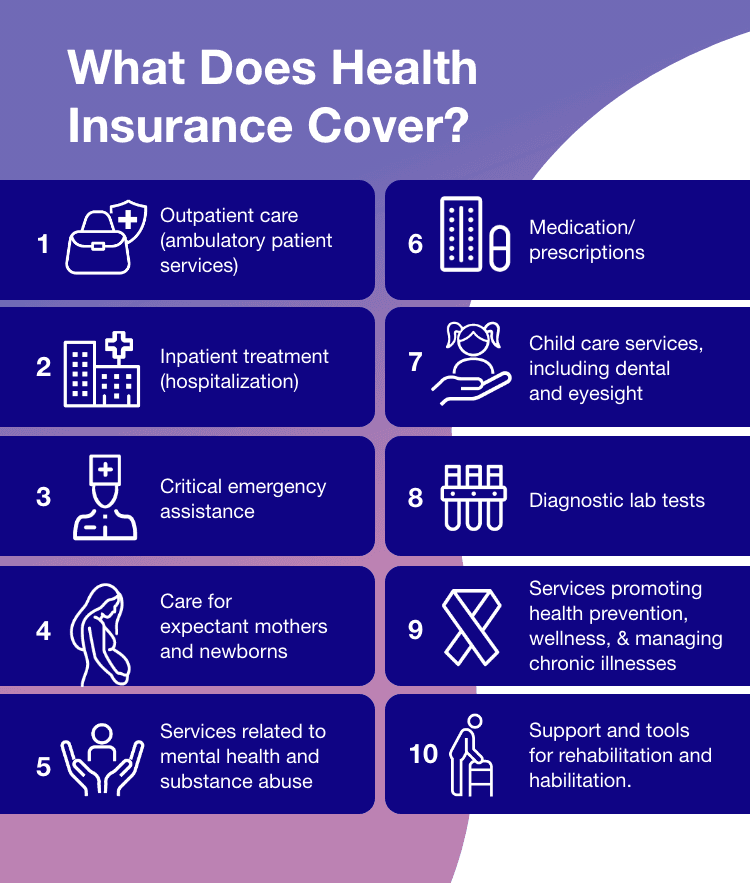

The Affordable Care Act brought uniformity to health insurance plan offerings. Before its implementation, the range of benefits between plans could vary. Today, if you’re browsing for health insurance in the Marketplace, you’ll find that every plan is mandated to include the following ten foundational benefits:

- Outpatient care (ambulatory patient services);

- Inpatient treatment (hospitalization);

- Critical emergency assistance;

- Care for expectant mothers and newborns;

- Services related to mental health and substance abuse;

- Medication/prescriptions;

- Child care services, including dental and eyesight;

- Diagnostic lab tests;

- Services promoting health prevention, wellness, and managing chronic illnesses;

- Support and tools for rehabilitation and habilitation.

Types of Health Insurance Plans

The health insurance landscape offers a range of plans tailored to individual needs. Typically, Floridians choose between these five types of plans:

Health Maintenance Organization (HMO)

An HMO offers members access to healthcare services through a designated group of healthcare providers. These arrangements tend to be more cost-effective, but participants are limited to certain physicians and specialists to enjoy full-coverage benefits.

Preferred Provider Organization (PPO)

With a PPO, members can consult with healthcare professionals outside their established network without a recommendation. However, this choice comes with higher expenses.

Point-of-Service Plan (POS)

A POS plan merges elements from both HMO and PPO. It functions similarly to an HMO when members access in-network care, but it also permits consultation with out-of-network practitioners, given you have a proper referral.

High-Deductible Health Plan (HDHP)

HDHPs feature larger deductibles yet often come with reduced premiums compared to other plans. They’re particularly suited for young and healthy individuals who don’t anticipate the need for frequent medical services.

Catastrophic Plan

Designed primarily for those below the age of 30, Catastrophic plans offer lower monthly payments and are structured to safeguard against substantial medical expenses arising from severe health incidents.

When considering a plan, remember that there’s no one-size-fits-all answer. Reflect on your lifestyle and healthcare needs. Do you visit specialists frequently? How do you feel about managing your care and paperwork? What can you afford in terms of premiums and out-of-pocket costs?

You might also want a customizable plan, as healthcare needs and lifestyles can change. Consider working with a health insurance advisor or using comparison tools online through healthcare.gov.

Health Insurance Terms

Diving into health insurance can feel like stepping into a new world. Here are some general terms to guide your way:

- Premiums: Think of this as your monthly subscription fee to your insurance.

- Deductibles: The amount you must pay before your insurer starts covering costs.

- Copayments: A fixed fee for certain services, like a doctor’s visit.

- Coinsurance: Your share of the costs of a covered service, usually as a percentage.

- Out-of-pocket Maximums: The most you’ll pay annually before your insurance covers all additional costs.

- Network: The group of healthcare providers with whom your insurer has cost agreements.

- Formulary: A list of prescription drugs your insurance plan covers more favorably.

- Exclusions: What your policy doesn’t cover.

- Pre-existing Condition: A health problem that existed before your insurance coverage started.

- Claim: A request for the insurance company to pay for services.

Although some terms may sound similar, understanding each is crucial when navigating your coverage and expenses.

What Are The Benefits Of Working With A Health Insurance Agent To Find Coverage?

Choosing the right health insurance plan is crucial, not just for your financial health, but for your physical well-being, too. This is where a health insurance specialist can be invaluable.

It’s possible to acquire health insurance coverage outside the federal exchange platforms in Florida. These off-exchange health insurance policies are available directly from insurers or via insurance professionals, predating the establishment of the Affordable Care Act (ACA).

Though such off-exchange policies might provide a broader range of plan choices and healthcare providers, they don’t qualify for ACA-related subsidies or tax benefits. When considering health insurance, weighing the benefits of both off-exchange and ACA marketplace plans is necessary to identify the most suitable fit for your circumstances.

A health insurance specialist brings a deep understanding of the intricacies of various plans. They can:

- Assess Your Needs: Everyone’s health and financial situation is unique. A specialist can analyze your medical history, anticipate future health needs, and gauge your financial capability to recommend plans that align with your specific requirements.

- Clarify Terms and Benefits: The world of health insurance is filled with jargon that can be confusing. A specialist can break down complex terms, ensuring you fully grasp the nuances of potential policies.

- Compare Plans: There are countless plans available, each with its own set of benefits, premiums, and out-of-pocket expenses. A specialist can compare these for you, highlighting the pros and cons of each and ultimately guiding you toward the most suitable option.

- Optimize Costs: By understanding how premiums relate to benefits and potential out-of-pocket expenses, a specialist can help you find a plan that offers the best value. This ensures you don’t overpay for coverage you don’t need or, conversely, are underinsured and face high, unexpected costs later.

- Guide on Premium Payments: Once a plan is chosen, the specialist can advise on the best payment frequency (monthly, quarterly, or annually) based on your cash flow and the plan’s terms.

Engaging with a health insurance specialist can simplify the often daunting task of selecting a plan. Their expertise ensures that when you start paying your premium, you invest in a plan that truly caters to your needs.

Coping with Medical Expenses

Medical expenses can be a significant cause of stress and financial strain. Whether it’s an emergency or a sudden procedure, a hefty medical bill can be daunting. But understanding and navigating these expenses can provide some relief.

For starters, it’s crucial to familiarize yourself with your medical bills. Ensure you thoroughly review them once received. Errors, though unintentional, can happen—be it a mischarge, a service billed but not rendered, or even incorrect patient details. By being vigilant and cross-checking your own records, you can identify and contest any discrepancies.

Another aspect to consider is Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts allow individuals to set aside pre-tax money for medical expenses, including deductibles and medications. An HSA is typically paired with high-deductible health plans; unused funds can roll over year-to-year.

On the other hand, an FSA is often use-it-or-lose-it, but it can be an excellent way to pay for medical and certain non-medical expenses with pre-tax dollars. Both options can provide a cushion and financial flexibility when dealing with healthcare costs.

Open Enrollment Period

The annual window from November 1 to January 15 allows individuals to sign up for a Marketplace health insurance plan. If you miss the Open Enrollment period, certain life events—such as marriage, childbirth, or losing existing health coverage might grant you eligibility for Marketplace coverage.

Remember: Employer-sponsored plans might have unique Open Enrollment dates, so consult with your employer for specifics. Enrollment for Medicaid or the Children’s Health Insurance Program (CHIP) is open year-round.

Tips for Choosing the Right Health Insurance Plan

- Self-assessment: Begin by evaluating your health needs and those of your family. Consider factors like the frequency of doctor visits, existing chronic conditions, or medications you’re taking. This will give you an idea of the kind of coverage you might need.

- Budget Balance: Determine your financial capacity for monthly premiums. Also, consider other out-of-pocket costs, such as co-pays, deductibles, and potential emergency medical expenses. Finding a plan that offers the coverage you need at a price you can afford is crucial.

- Preferred Providers: Ensure that the doctors and specialists you trust and your preferred hospitals and pharmacies are in-network. Out-of-network care can be significantly more expensive, and it’s essential for continuity of care to stay with providers you trust.

- Plan Features and Benefits: Beyond the basics, some plans offer additional features like wellness programs, telehealth services, and discounts on other health-related services. Assess what’s important to you and what you might use.

- Seek Expert Guidance: Consulting professionals can make a big difference. Licensed agents at Live Health Insurance are equipped with knowledge about various plans in the market. Their expertise can offer insights, answer questions, and guide you toward a plan tailored to your needs.

Remember, choosing a health insurance plan is about securing peace of mind and ensuring you and your loved ones receive the best care when you need it.